When thinking about major financial decisions, such as purchasing a car, leasing a car, or obtaining a mortgage, your credit score is a big influencer. It is what lenders use to determine if you are a reliable borrower. For example, if you are a recent immigrant to the UK, it means you have to build your credit score from scratch, as your credit history from your homeland is not transferred. The good thing is that you can reach a high credit score with the right amount of effort and clever methods.

What is a Score on Credit?

Credit scores are an indicator of the number you have used to measure your creditworthiness. Landlords, banks, and other organizations use it to assess the likelihood that you will pay back your debts. Two of the most important elements in your credit report include:

- Credit Histories: A record of your repayment and borrowing activities is yours.

- Credit report: It is a detailed and comprehensive summary of your credit record, which includes data about credit card companies, as well as other financial institutions.

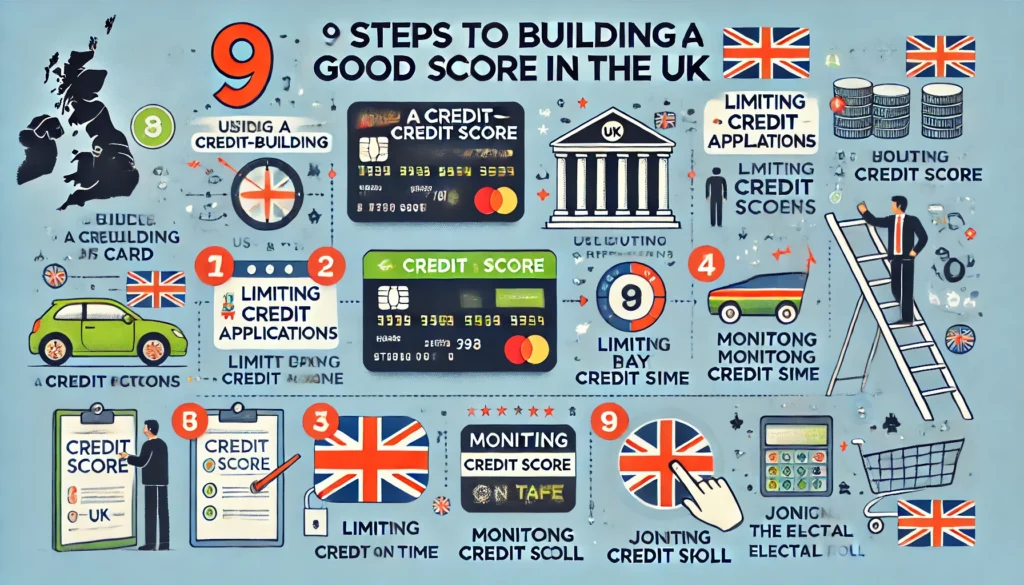

Steps to Build and Boost Your Credit Score

Get a Credit-Building Credit Card

Credit-builder credit cards are intended for people with little to no credit history. They usually have more stringent repayment terms and a low credit limit (between PS150 and PS200). Your credit score can be raised by responsible use, such as paying off the entire monthly Balance.

Limit Credit Applications

Your credit score might decrease if you apply for a lot of credit cards over a short period of time. An individual application has a “challenging inquiry” listed in your credit report, which can be a potential issue for lenders.

Maintain Low Credit Utilization

Don’t use more than 60 – 70 per cent of your credit limits. Even if you pay the entire Balance If you are borrowing more than the limit, it could indicate financial dependence on credit.

Join the Electoral Roll

If you are eligible, signing up on the electoral roll gives legitimacy to your address and helps establish your identity for credit institutions. The simple act of registering can dramatically increase your score.

Pay Bills in Full and On Time

Make sure you pay off your credit card in full before the deadline. Making late payments or even paying less than required can hurt your credit score and also come with additional charges.

Always Monitor Your Credit Score

To keep track of your score, use CreditWise or ClearScore. These tools monitor your score without putting it at risk. A lot of banks, including NatWest, provide free services to monitor your credit score.

Avoid Unnecessary Debt

Be cautious when borrowing money unless it is absolutely required. An impeccable debt record is important when trying to establish credit.

Update Addresses on Active Accounts

Check that your address matches for all accounts in your financial as well as utility bills, and even subscriptions. Incorrect addresses could lead to rejection of credit applications.

Never Balk at Cash Operating a Credit Card

Banks view cash withdrawals as risky. They can signal financial instability and may result in high charges.

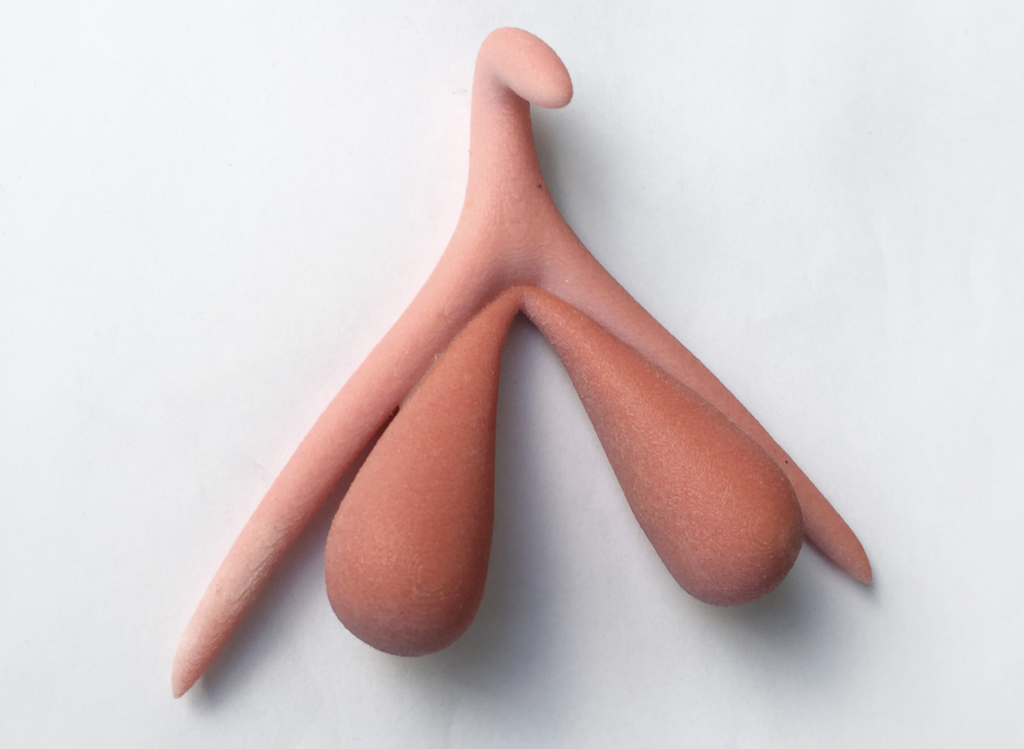

Understanding Credit-Building Cards

Credit-building cards differ from regular credit cards mostly in terms of borrowing and repaying. They begin with a small credit limit and reward you for responsible use with a gradual increase in credit limit and scoring. In contrast to debit cards that immediately deduct the Balance of your account, Credit cards permit the borrower to take out loans for a short period of time. If you don’t pay back your entire Balance every month, it could result in high charges for Interest (APR) as well as penalties.

What is APR?

Interest on any money borrowed is guided by APR. The Annual Percentage Rate is also an indicator of how much risk is involved in lending money to a particular borrower. A high APR means high risk. A low APR means the borrower is more dependable. Please mention that not every applicant will be eligible for the advertised APR.

Lenders reserve the right to offer higher rates depending on your credit profile.

Smart Credit Card Usage

For a more efficient management of your credit card, and improve your credit score:

- Utilize your credit card to pay periodic, fixed costs such as utility bills or subscriptions.

- Create an automatic debit on your account at the bank to ensure that payments are paid in full and on time.

- Do not exceed the credit limit. For example, if your credit limit is PS200, you should try to spend less than PS100 – PS150.

Credit Cards and Debit Cards Compared

You should know that there is a difference between debit and credit cards:

Credit Card Debit Card

Cash borrowed from Personal money.

Credit score affects the credit score. Credit score does not change.

Aids in building credit histories. Credit history cannot be built.

It could be subject to Interest if fully paid. Interest is not charged; however, the fees for overdrafts are applicable.

Limited by the credit limit, the Balance of the account

More Advice for Establishing Credit in the UK

Establishing automated Payments for essential services, such as utilities and other recurring subscriptions, can demonstrate responsibility.

Avoid Financial Dependence with Untrustworthy People: If one partner in a shared account or some financially connected situation has a poor credit score, this may adversely affect you.

Disputed Errors on Your Credit Report: Regularly inspect your credit report for inaccuracies and if you spot some, dispute them with the credit bureau.

Final Reviews

It takes time and patience to achieve your dream credit score. With a high credit score, you can rent your ideal places and get approved for loans and mortgages.

As you strive for financial security, good luck! UK Medics is here to help you build your credit score!